Hello!

As a brief introduction, I’m Adrian, and I’m what I like to call a Numbers Guy (demand planner, operations manager, data analyst, etc) at a small brewery in Van Nuys.

Over the last year or so, I’ve slowly built a pile of spreadsheets, python scripts, and ad-hoc analyses that cover anything from mug club pricing, to brew date planning based on supplies and demand (not the concept), to the statistical effect on revenue of, say, adding a pizza kitchen, or changing beer prices, and I feel like what I’ve found is interesting and odd enough that I’d like to share it.

So, without further ado, let’s dive into the first part of a small series on Opportunity Cost !

Full disclosure, I got a D- in Econ 101 (I went maybe three times and didn’t do the homework, granted), but there was this very cool concept we learned about called Opportunity Cost. The gist is that, where you have multiple options for, say, making money, choosing one option results in making less than another.

While it seems obvious that you’d always just take more money, here are a few examples in the beer game that illustrate the subtlety of this choice, and often the opacity of the “value” of the options:

- managerial staff (owners, for example) helping out with menial work (labelling, brewing)

- one example would be owners doing secretarial work for themselves instead of hiring someone, because the labor is “free”

- this isn’t necessarily bad, but how much time are we talking? How much would it cost to hire someone?

- a particular favorite of mine: whether or not to cap the amount of, say, a popular can SKU you set aside for distro (the heart of the argument being that the margin in a tasting room is way higher than in distro)

- and a subset of this: pursuing new, low-margin businesses (like expanding distro) over improving existing high-margin businesses (streamlining labor and organization in a taproom)

- selling every last keg of a low-performing beer when a popular one is waiting in the wings

Obviously we’ll go over each of these, but I thought we’d start with the last one, which I think is both surprising and a wonderful example of the low cost of kegs of beer and the high value of pints, and how that simple idea can have huge practical implications

So, first of all, the assumptions:

- the number of pints sold per day (on average, i.e. over time) is not fixed, but depends to some degree on the quality of the product (from bartender to beer)

- a caveat: there is definitely a max number, but I’ll assume you’re not at that extreme

- you’re using every single line available

- an average 1/2 BBL keg of beer costs, say, $100, and you’re selling “16 oz” (13.5 after head loss) pints of beer at $8 each

- your “unpopular” beer is being sold at a rate of .060 BBL/day, and you’ve determined that your popular beer will probably sell at double that, or .120 BBL/day

- these are both pretty in line with our actual numbers

- let’s say that initially you have one pallet, or 4 BBL (8 1/2 BBL kegs) of slow beer left

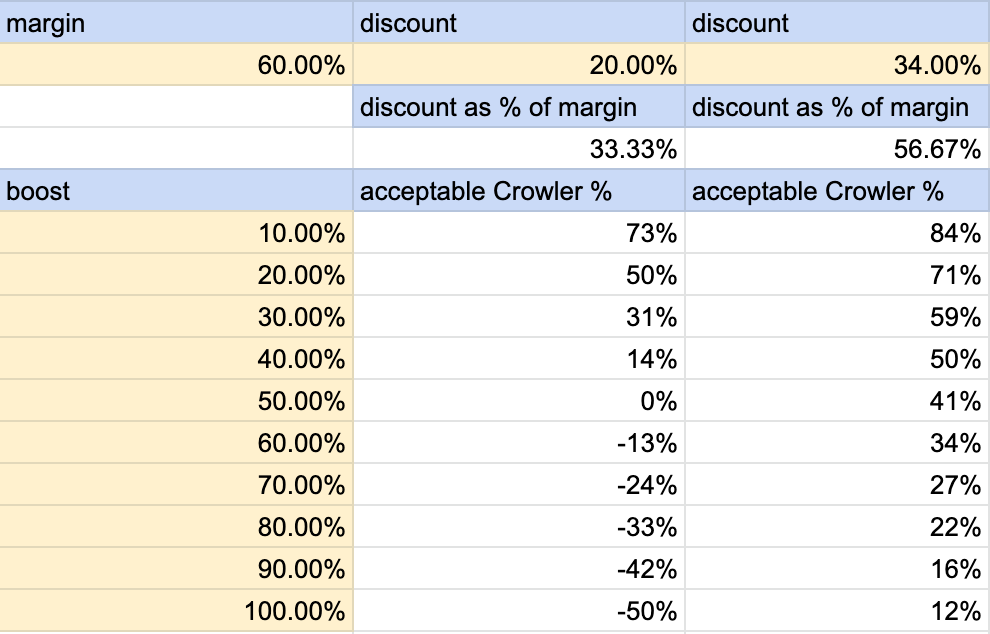

- finally, let’s assume your taproom has a profit margin of 60%, and that your pouring efficiency is 95% for draft beers (i.e. you only lose 5% of a keg to foam spillage and dumped beers)

And the scenario, which is quite simple: you’ve brewed more beers than you have lines, so at least one beer is waiting to be tapped. Let’s also say you have a beer on a line that’s not selling super well, and of which you don’t have a ton on hand (let’s say less than 8 kegs). The question is, when should you dump this beer?

First, let’s look at the profit per day for each item, which is simply (BBL/day)*(Revenue/BBL)*margin. To get that, we need the Revenue per BBL, which is the following:

Rev/BBL = (Rev/Pint)*(Pint/BBL)*efficiency = $8*(3968/13.5)*95% = $2,230

And Profit/BBL = $2,200*60% = $1,340

slow beer: .060*$1,340 = $80

fast beer = 2*slow beer = $160

Thus, if we replace the slow beer with the fast beer, we’ll make an extra $80/day (again, we assume that the number of pints sold per day is not fixed - we may touch on this later, and how to numerically evaluate this claim with enough data, but for now I’ll say this: if I’m at an amazing bar, I’ll get 3+ drinks and make sure to return; if I’m at an okay bar, I’ll get one beer and never come back)

Getting closer! How many days will the current beer last?

days_left = bbl_left/demand = 4/.060 = 67

What’s the cost to dump?

cost_to_dump = $100*bbl_left*2 = $800

(the 2 is to account for our $100 per 1/2 BBL keg figure)

What’s the profit over that period if we swap to a better beer?

prof_if_dump = relative_profit*days = $79*67 = $5,300

So, what’s the profit overall from dumping the beer?

$5,300 - $800 = $4,500

Which is insane. The profit, real actual US dollars profit, you’d extract from your tasting room from dumping out (literally down the drain!) a pretty huge amount of beer and putting on a more popular one is a staggering $4,500 over a two month period. That’s the additional profit for just one line of beer!

And before that seems like a contrived scenario, we literally just did that - in our case, just taking down an outside beer which we usually have on year-round and putting up a tried-and-true popular beer, which we also had in cans (on the first day, it was our best seller). Nuts!

But you may be thinking that the whole notion of “days to outage” is extraneous - the fact that it’s a good idea to dump doesn’t seem to depend on when you dump the beer, implying ASAP is the best time to do it, so is there a more general equation that tells us whether or not to dump a beer, at any point, for a more popular one? Algebra says yes. We want the revenue per day after swapping to equal (i.e. break-even with) the cost of dumping, so:

prof_per_day = (fast demand - slow demand)*(profit per barrel)

cost_per_day = (cost per bbl)*(slow demand)

(a good sign: the units of both of these is $/day)

so: prof_per_day = cost_per_day

(fast demand - slow demand)*(profit per bbl) = (cost per bbl)*(slow demand)

(fast demand - slow demand)/(slow demand) = (cost per bbl)/(profit per bbl)

This is the break-even condition, so if the left side is greater than the right side, we should dump (i.e. the overall profit is the left side minus the right side). Interesting! So a few things about this equation:

- as slow demand goes to zero, your cost per bbl would have to be infinitely larger than your profit per barrel to justify dumping i.e. you’re selling so little that it’s a near certainty that you should dump, which is true

- things that make dumping a good idea: higher profit per barrel, slower demand for the slow beer, higher demand difference between the two beers, and lower cost per barrel, which all check out! So this is probably a correct equation

Let’s plug in our numbers:

(.120 - .060)/(.060) >? ($200)/($1,320)

1 >? .15

So indeed! We should dump. And further, and this is also nuts, if the difference in demand is a mere 15% of the demand of our slow beer, we should dump; so if, say, our popular beer were the slow one, we’d only need a beer to sell an extra .018 BBL/day to justify dumping any quantity of our current beer in order to get the new one tapped

So, a big corollary: you should “never” brew a beer that you suspect to be less popular than your current least-popular beer. While this is true in our context when all of your lines are full, I think it applies generally, with the exception of risky new styles (and even then, if you have more than like 10 beers, the slowest seller will generally set the bar low). Clearly, given the massive cost/profit ratio for brewing/selling beer, you should sharkishly sell good beers without hesitation over nursing your slow-selling darlings

And if you’re wondering how this applies to you specifically, you’re welcome to use the above and following formulas, and if dump_profit is a positive number, for example, by all means dump the current beer:

dump_profit = prof_if_dump - cost_to_dump

given:

prof_if_dump = prof_diff*days_left

prof_diff = (revenue per keg)*(taproom margin)*[(BBL/day of fast beer) - (BBL/day of slow beer)] days_left = (BBL left of slow beer)/(BBL/day of slow beer)

and: cost_to_dump = (cost to manufacture BBL of beer)*(BBL left of slow beer)

Thanks for reading, and see ya next week!

- Adrian